Order us to compute your specific investment project for you, thus you can make a sound decision before the actual investment is executed.

Make or Buy

Often it is difficult to properly assess the benefits of an investment. With a lot of experience and routine in querying and evaluating relevant data, we analyze and structure the data and compute by means of the Net Present Value method and on basis of your internal interest rate the payback period of your investment. Computed data are plotted in a trend chart for decision-making.

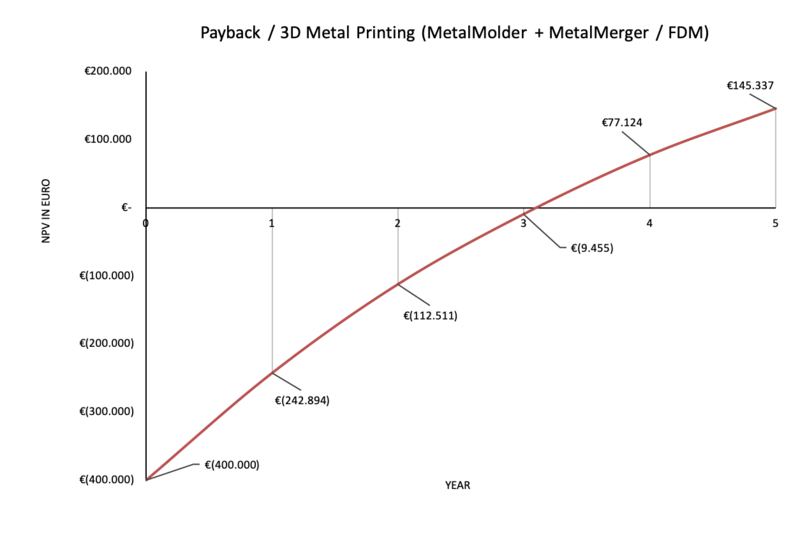

Outcome of the Net Present Value analysis

The graph shows a payback curve for an investment in an “FDM Metal Printer + MetalMerger” in the amount of €400,000.–. In this case, the investment has paid back in slightly more than a three years period, generating a surplus of €77,124.– in the fourth year and a surplus of €145,337.– in the fifth year. This example was calculated with an internal rate of interest of 10% and a total tax rate of 32% (corporate tax + municipal tax):